The Evolving Relationship Between Stocks and Bonds

Sir John Templeton once said, “The four most expensive words in investing are: ‘This time it’s different.'” And normally, we would agree. But the phrase “This time it’s different” may apply to what's happened in financial markets in recent years.

What’s new?

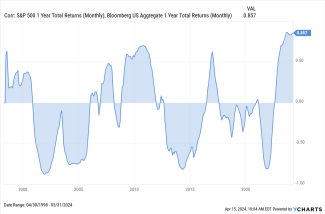

For most of the past quarter-century, stocks and bonds have moved in opposite directions. This movement created what’s called a negative correlation between these two asset classes. But in recent months, the correlation between stocks and bonds hit multi-decade highs. As you can see in the chart above (courtesy of YCharts), the correlation between the S&P 500 and the Bloomberg US Aggregate 1-year total return has been quite high. In other words, stocks and bonds are moving in the same direction. That positive correlation is starting to raise questions about the benefits of a diversified portfolio. Remember, diversification is an approach to help manage, but not eliminate, investment risk.1

What’s the cause?

The positive correlation began in 2022, but the most recent activity spotlighted the issue. As the Fed started raising interest rates in 2022 to manage inflation, bond prices (which generally move in the opposite direction of bond yields) trended lower. At the same time, economic concerns put pressure on stocks, which fell into bear market territory for much of 2022.2

The result: traditional diversification didn't produce its expected results.

What’s next?

The answer to this question may depend on how the economy unfolds over the next few months, which is why the Fed is getting so much attention. Late last year, the Fed signaled that its next move would be to lower short-term interest rates, but it stopped short of giving a timeline.

Stocks and bonds trended together as Wall Street began to think the Fed may have pulled off a “soft landing,” where growth slows but the economy doesn’t tip into a recession. However, inflation is still sticky, so the Fed has been unwilling to change its policy, as it is waiting for consumer prices to stabilize.3

But what happens in the event of a hard landing? The ramifications could include job losses, credit tightening, and market volatility. This may create a world where bonds and stocks might move in opposite directions and, voila, produce a negative correlation. But not too many people appear to be cheering for a hard landing.

A third possibility is "no landing," in which the Fed keeps rates at their current levels for a long period because inflation remains high. It’s unclear how this would affect the correlation between stocks and bonds.

Our Perspective

There is a school of thought that the recent positive correlation between stocks and bonds is a return to historical norms rather than an anomaly.

One longer-term study showed that the past three decades of negative correlation where stocks and bonds moved in different directions should not trump three centuries of data showing that these asset classes moved more in sync.1

The study concluded that although the past two years have been rough, diversification should not be discarded as an investment concept. However, it did suggest that the economy appears to have moved past a long period of low inflation, which allowed the Fed to keep interest rates at low levels.

Helping clients

The traditional approach to diversification has relied on the negative correlation between bonds and stocks to help smooth out the investment journey. But in some instances, today’s positive correlation may have a bit of the opposite effect.

When we create a portfolio strategy, we base it on an investor’s goals, time horizon, and risk tolerance. Changes to any one of these factors can cause us to reconsider our original approach.

At the same time, we are constantly monitoring the overall investment climate, and we continue to learn so that we can bring new insights to clients. In the back of our minds, we hear Sir John Templeton saying, “The four most expensive words...” but we never sit still when it comes to learning about money management.

1. MFS, October 2024. Stocks are represented by the S&P 500 Composite Index is an unmanaged index that is considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost. Bonds are represented by the 10-year U.S. Treasury, which are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid.

https://www.mfs.com/en-us/investment-professional/insights/market-insights/far-flung-past-prologue.html?utm_source=ola_riabiz_direct&utm_medium=384487755&utm_term=segm_financial_advisors&utm_campaign=mfs_fy24_retail_campaign&utm_content=212135772

2. Charles Schwab, March 2024 https://www.schwab.com/learn/story/how-correlation-can-dilute-diversification